ASEAN/East Asian Alternative to China in India’s Import Market

India’s import market has been growing steadily at 6.8% for last four year between 2014 and 2018. Value of goods imported by India has soared to $ 507 Bn in 2018 from $ 390 Bn in 2014. Growth of imports in India has remained consistent with its GDP growth, which also hovered between 7-8% during this duration, in fact India’s GDP grew at 6.8% during 2018. Strong GDP growth also fueled the domestic consumption market, which is evident from the rise in import from ASEAN/East Asian countries, while that of Industrials & technology heavy Europeans have remained stagnant or declined.

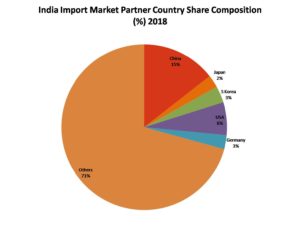

China by far remains the largest import partner of India. It alone accounts for 16% of overall imports by India and has huge lead over any other major economy. Other Asian major economies such as Japan and S Korea account for only 2%-3% of the total imports. USA, the biggest economy of the world accounts for only 6% of India’s imports.

Source: UNCOMTRADE

Standalone Trade figures make it looks impossible to find alternative to China or a major competitor in the near term. If we combine the trade share of major European economies such as UK, Germany, France, Italy & Netherlands, together they still account for only 7% of Indian imports in 2018. But if we look at the share of ASEAN and East Asian countries combined then we a very different picture.

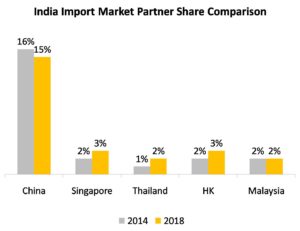

Japan, Korea along with ASEAN countries such as Singapore, Thailand, Indonesia and Malaysia accounted for 18% of India’s imports in 2018. All these countries are located in the same region and are not only geographically close to China but also economically well linked with China. Most the major western countries have developed manufacturing hub linked between China and ASEAN countries and supply chain spread over the region.

Between 2014 and 2018, Share of these Asian countries in India’s imports rose from 17% in 2014 to 18% in 2018, and that of China declined from 16% in 2014 to 15% in 2018. While share of Japan and S Korea remained constant, share of Singapore, Thailand and Hong Kong in India’s imports rose during this period. Indonesia was only ASEAN nation whose share in India’s imports declined during 2014-2018 period.

This analysis is based on the data insight generated by Viksa Market Insights, which has strong expertise in Trade Analysis products & services across the globe.