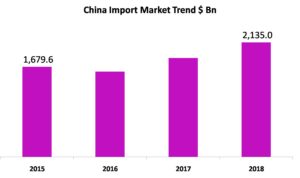

China’s $ 2.1 Trillion Import Market Grows at 6.1%; Asia Dominates

China’s overall import market is growing has grown at CAGR of 6% during 2015-18 period. In 2018 overall imports stood at whooping $2.1 Trillion, just a few years back in 2015 it stood at $1.6 Trillion. China’s $2.1 Trillion Import Market import has grown at much closer rate to its GDP growth rate during this period.

China’s import requirement is vast and barring 2016 it has grown in all the years between 2015 & 2018. Chinese import sourcing is diversified to great extent as no single player has dominant position in its import market. Major economies of Asia and trans Atlantic also happen to be major players in the import market with exception of India which has minuscule share in the market.

China’s import market has lot of dependence on the neighbouring economies as Japan, S Korea and Taiwan together account for 26% of its imports. Germany, the biggest European economy accounts for only 5% of Chinese imports. USA the largest economy in the globe accounts for only 7% of the Chinese imports.

Amongst the BRIC countries Brazil, Russia and S Africa have better share in imports compared to India. All of the three countries with major play in commodities and energy have good presence in China’s import market. Brazil has highest share amongst BRICS countries in Chinese imports at 3.6%, followed by Russia at 2.8% and S Africa at 1.3%, all of them providing commodities to drive China’s exports and energy to feed domestic economy of China.

USA though is one of the major exporters to China but its exports aren’t growing even at the rate China’s imports are growing. US exports to China has grown meagrely at CAGR of 1.2% during 2015-18 period. South Korea the biggest import part of China also managed to grow at CAGR of 4.1% during this period.

Japan and Taiwan are two major trading partners which are growing at above 5% rate. Japan’s exports to China have grown at CAGR of 6% during this period while Taiwan has grown at 5.5% during the same period. Japanese exports to China has been able to match growth at which China’s import market is growing reflects significantly on the nature of products transacted for import and re-exports.