Phoenix IPOs: Will Low Margin GNA Axles rise again?

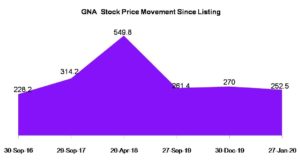

GNA Axles Ltd (NSE: GNA) has been a mid level automotive components manufacturing company for over two decades since it came into existence in mid 1990s. After being in existence for long the company took the IPO route in 2016 with issue price of Rs 207 and got listed by the end of September 2017 at Rs 228. Company’s factored growth played in the market and it peaked out by April 2018 when its share price rose to Rs 549.8 and then the decline of the share began. By the time it completed three years of listing, the stock had crashed to Rs 261 as company started struggling with delivering growth and margin.

Profitless Growth

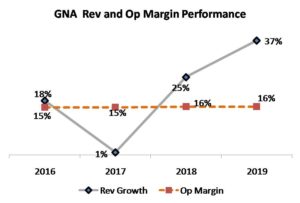

GNA’s decline has continued in 2020 as it reached low of Rs 252 on 27 Jan. The reason for GNA decline can be attributed to it performance and current macroeconomic environment. The company well scripted its revenue growth which doubled between 2015 and 2019, from Rs 456 cr to Rs 928 cr in 2019. Despite this company has witnessed decline which can be attributed to its stagnant Op Margin levels at 15-16%, reflecting revenue growth without improvement in profitability.

Failure to improve profit margin has weighed upon the company and it the fundamental issue with its manufacturing operations.

Vs Peers

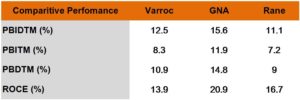

Though GNA’s poor profit and growth management has led to its downfall but the stock is not entirely a letdown as assessed on Peer performance on certain financial parameters. GNA despite its low margin delivery has higher PBIDTM & PBITM compared to companies such as Varroc and Rane(Madras).

GNA is the only company amongst its competitors to have double digit PBITM of 11.9% in 2019 when both Rane and Varroc delivered 7-8% margin.

Where Does GNA stand on Investor confidence?

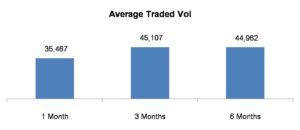

At macro level investor confidence can be gauged in terms of market participation which is reflected on increase in trading volume levels. If we look at the trading volume of the GNA scrip for past six months we identify if any trend is emerging. The trading volume of GNA share has not witnessed any enthusiasm on part of retail investor as its both 6-month and 3-month trading volume has remained in the range of 45K but more significantly the 1-month trading volume declined to 35k on NSE signifying lack of renewed interest.

If we look at the price performance of the share then GNA is still trading below both 200Days moving Avg of 264 and 100Days moving Avg of 259, implying long way ahead for GNA’s market recovery.