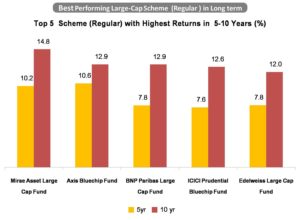

Top Five: Large-Cap Regular Funds with 10-14% Returns in Long-term

There are 28 Large Cap Regular Mutual Fund schemes operating in Indian market and a large number of these schemes are in operation for long duration of 10 years. While some schemes have performed well during short to medium term range of 1 to 3 year period a few of these schemes have managed to deliver 10-14% returns during 5-10 year period. Top Five large-cap Regular funds delivered highest returns during long-term period. Mirae Asset Large Cap Fund, Axis Bluechip Fund, BNP Paribas Large Cap Fund, ICICI Prudential Bluechip Fund and Edelweiss Large Cap Fund are the best performing schemes with highest returns.

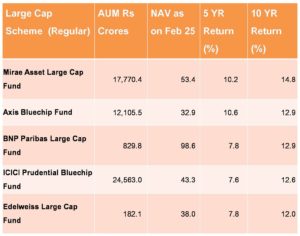

Source: AMFI

Out of the Top five Large Cap Regular Schemes only three are from Top 10 Largecap Fund Schemes in terms of Size AUM, ICIC Prudential Bluechip, Axis Bluechip and Mirae Asset Large Cap are the only three funds from large size AUM to deliver highest returns. Two smaller schemes BNP Paribas Large Cap Fund and Edelweiss Large Cap Fund have also managed to beat much larger funds in terms of delivering returns.

Mirae Asset Large Cap is the top performing scheme, it has delivered 14.8% returns during 10year period and 10.2% returns during 5year period. Axis Bluechip Fund is the second best performer. Though the scheme along with BNP Paribas Large Cap are tied delivering 12.9% returns during 10year period but Axis Bluechip Fund beats BNP Paribas fund in delivering higher returns during 5year period at 10.6%.

All the fund schemes ranked from 3 to 5 have delivered returns above 12% during 10year period and above 7% during 5year period. ICICI Prudential Bluechip Fund is at fourth position with 12.6% returns during 10year period. Edelweiss is at fifth position with 12% returns during 10year period.

Edelweiss Large Cap Fund is also the cheapest top performing large cap mutual fund with NAV at just Rs38. BNP Paribas is the most expensive mutual fund amongst top five with NAV at Rs98.6.